Summary

Total transaction value amounts to approximately MEUR 1,700, of which the purchase price amounts to approximately MEUR 1,400 and net debt Dalata to approximately MEUR 300. Total transaction value after the expected divestment to Scandic, which is expected to take place during the second half of 2025, amounts to MEUR 1,200, equivalent of approximately MSEK 13,300.

Rental income is expected to increase by approximately MSEK 1,200 – with an estimated profitability in line with Pandox’s already existing lease agreements in the UK and Ireland – and cash earnings is expected to increase by the equivalent of approximately MSEK 450, on an annual basis. This corresponds to approximately SEK 2.30 per share, an increase of more than 20 percent measured on a rolling twelve-month basis (per 30 September 2025).

31 Investment properties with a value of approximately MSEK 16,700 and an estimated average weighted property yield of 6.95 percent will be added to business segment Leases. This corresponds to a value creation of approximately MSEK 3,000 million, or approximately SEK 15 per share, as the properties are acquired at an implied value of approximately MSEK 13,700 with an estimated initial yield of approximately 8.40 percent, including expected transaction costs.

Dalata owns and operates 56 hotels, of which 31 in self-owned properties (Investment Properties), 22 under lease agreements with external property owners and 3 under management agreements.

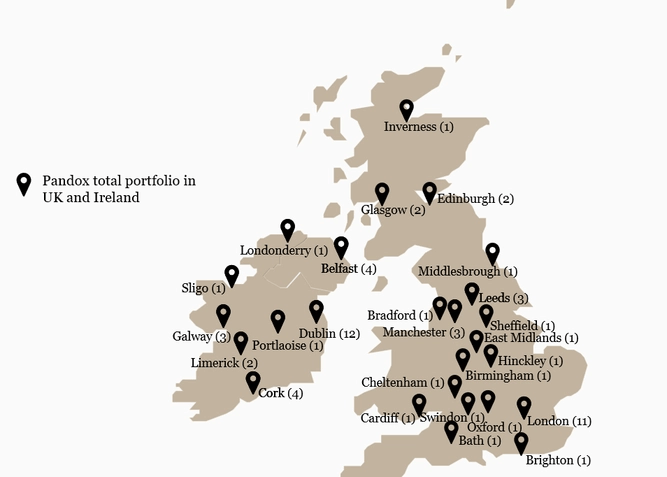

The acquisition is made with Scandic Hotel Group (Scandic) as operating partner, where Pandox, following a separation of Dalata's operations into a property ownership and a hotel-operating part, retains 31 Investment Properties in Ireland and the UK.

Following the separation, the intention is that Scandic acquires the complete operating platform, which comprises a total of 56 hotel operations, for MEUR 500.

The 31 Investment Properties retained by Pandox will be operated by Scandic under new long-term revenue-based leases with guaranteed minimum levels.

During the separation process, Scandic will also operate all 56 hotel operations under management agreements with Pandox.